Check My Credit Score UK: 20 Common Questions Answered Honestly

Understanding your credit score is crucial for financial health in the UK. Whether you're planning to apply for a mortgage, loan, or credit card, knowing where you stand can make all the difference. In this comprehensive guide, we answer 20 of the most common questions people ask when they want to check my credit score UK. [more...]

Identity Theft Alert: How to Monitor Your Credit Online and Protect Your Financial Future

Identity theft is one of the fastest-growing forms of financial crime in the UK. Each year, millions of people discover that fraudsters have used their personal information to open credit accounts, apply for loans, or damage their financial reputation. [more...]

Why You Must Check Credit Report History: Credit History Check UK 2026

In the UK, many people still assume that performing a single annual credit check is sufficient to maintain financial health. However, in 2026, this approach is increasingly outdated. With identity theft on the rise, real-time lender reporting, and automated credit decisions, relying on a one-time check leaves gaps in your financial security. [more...]

Car Finance and Credit Checks: What to Expect Before You Apply

Applying for car finance is a common way for UK drivers to spread the cost of buying a vehicle. However, before any agreement is approved, lenders will carry out credit checks to assess your financial reliability. Understanding how these checks work can help you prepare, avoid surprises, and improve your chances of acceptance. [more...]

Store Cards vs Credit Cards: Which Is Better for Your UK Credit Score?

When you’re at the checkout in Argos, Marks & Spencer, or John Lewis and the cashier offers 10% off with a new store card, it can be tempting to accept. But before you sign up, it’s important to understand how store cards compare to traditional credit cards - and which option is better for your UK credit score. [more...]

Redundancy and Your UK Credit Score Check: What to Monitor

Redundancy can bring sudden financial uncertainty, particularly when it comes to managing existing credit commitments. While losing a job is emotionally challenging, it can also place pressure on your finances, making it harder to stay on top of payments and borrowing. As a result, many people worry whether redundancy will affect their ability to check my credit score UK or whether it could permanently damage their financial record. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

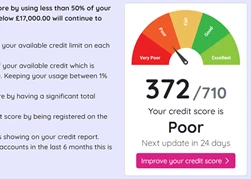

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.