What Affects Your Credit Score the Most?

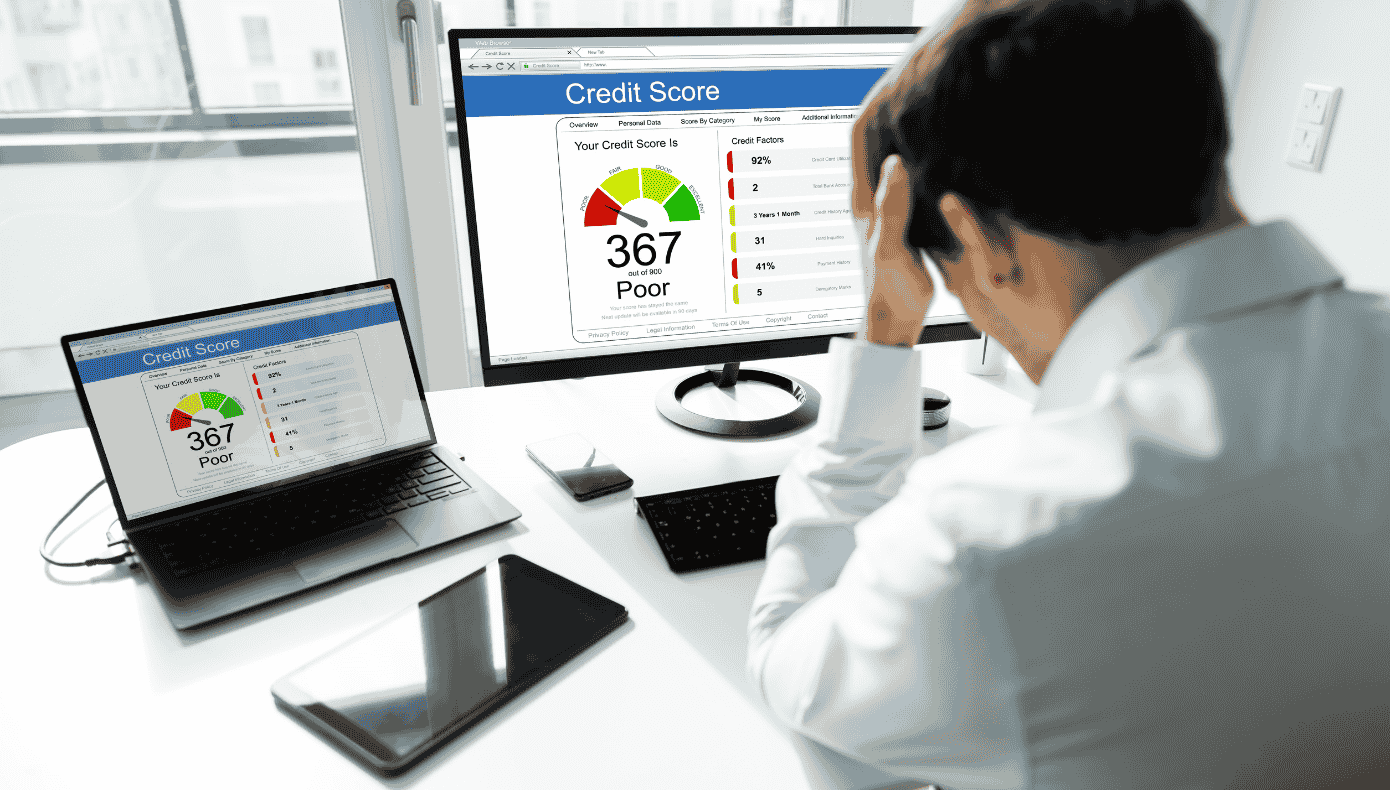

Your credit score can open doors - or slam them shut. From getting approved for a mortgage to securing car finance or even renting a flat, this single number can shape your financial future. Yet most people don’t actually know what affects their score the most. [more...]

10 Crazy Things That Can Hurt Your Credit Score Without You Knowing

Your credit score can feel like an invisible number, quietly influencing your financial life. From getting a mortgage to opening a new bank account, your credit score is more important than many people realise. Most UK residents know the basics - pay bills on time, don’t miss payments - but there are some unexpected things that can damage your credit score without you even knowing. [more...]

Credit Check Online: Everything You Need to Know in 2025

Your credit score is one of the most important numbers in your financial life. It influences whether you can get a mortgage, rent a property, secure a car loan, or even open a new phone contract. In the UK, the ability to do a quick credit check online makes it easier than ever to take control of your financial profile. [more...]

Credit Report vs. Credit Score: What’s the Difference and Why Both Matter in the UK

When it comes to financial planning in the UK, two terms often confuse people - credit report and credit score. While both are connected, they are not the same. Understanding the difference and knowing how to carry out a credit history check UK or how to check credit report history can help you stay on top of your finances and improve your chances of approval when applying for loans, mortgages, or even mobile contracts. [more...]

The Difference Between Experian, Equifax and TransUnion Credit Reports

When it comes to credit checks in the UK, three main credit reference agencies (CRAs) provide your credit information: Experian, Equifax, and TransUnion. While they all aim to give lenders an overview of your financial behaviour, their reports can differ in several ways. [more...]

How Your Credit Utilisation Ratio Impacts Your Credit Score

When it comes to building and maintaining a healthy credit score, one of the most important factors lenders assess is your credit utilisation ratio. Understanding and managing this ratio can significantly improve your financial standing and boost your chances of credit approval. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.