Check Credit Report History for Medical Debt: New 2026 Rules Explained

If you haven’t taken time to check credit report history recently, 2026 is the year to prioritise it. Updated reporting standards around medical debt are changing how certain debts appear on credit files, how long they remain visible, and how lenders interpret them during affordability checks. [more...]

Can a Free Credit Score Checker Detect Fraud?

Using a free credit score checker like Credit Check Online can help you spot early warning signs of fraud before serious damage is done. If you regularly check your credit score in the UK, you can quickly identify suspicious activity and take action. [more...]

Credit Check Online: Top 10 UK Platforms to Check Your Credit Score

Monitoring your credit score is an essential financial habit. Whether you’re preparing for a mortgage, planning a loan, or simply keeping track of your finances, performing a credit score check can help you spot errors, detect fraud, and make informed financial decisions. [more...]

The Connection Between Bank Overdrafts and Your Credit Score

Bank overdrafts are a common financial tool in the UK, offering short-term flexibility when money is tight. However, many people are unsure how overdrafts affect their credit profile. Understanding the connection between bank overdrafts and your credit score can help you manage borrowing more responsibly and avoid unnecessary damage to your financial record. [more...]

Can You Improve Your Credit Score Without a Credit Card?

Many people in the UK believe that owning a credit card is essential for building a good credit score. While credit cards can help, they are not the only way to improve your credit profile. It is entirely possible to improve your credit score without a credit card by managing other financial commitments responsibly. [more...]

Credit Check Online FAQ: 20 Honest Answers About Credit

A credit check online is one of the easiest ways to monitor your financial health from the comfort of your home. Whether you're preparing for a mortgage application or simply want to understand your creditworthiness, knowing how to perform a credit check online is essential. Here are 20 honest answers to the most common questions about credit checks and online credit monitoring. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

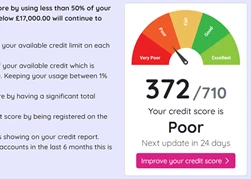

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

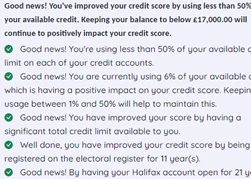

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.