How Often Should You Check Your Credit Score in the UK?

Your credit score plays a crucial role in determining your financial opportunities, from getting a mortgage to applying for a loan or even renting a flat. Many people, however, are unsure how frequently they should check their credit score. Let’s break down the best practices for monitoring your credit score in the UK and why it matters. [more...]

Marriage & Money: Does Your Partner’s Credit Score Matter?

Plans for the wedding, honeymoon, and beginning a new life together are often the topics of conversation when you are engaged to be married. But one important subject often gets avoided because it feels too personal or uncomfortable: credit scores. [more...]

The Role of Credit in Renting a Flat in the UK

Finding the ideal flat to rent in the UK can feel daunting, and the process often comes with challenges. Among the most important considerations that may decide whether you receive the keys or encounter a rejection is your credit history. To many tenants, knowing the role of credit in renting a flat is the difference between enjoying their ideal home and having to extend the search. [more...]

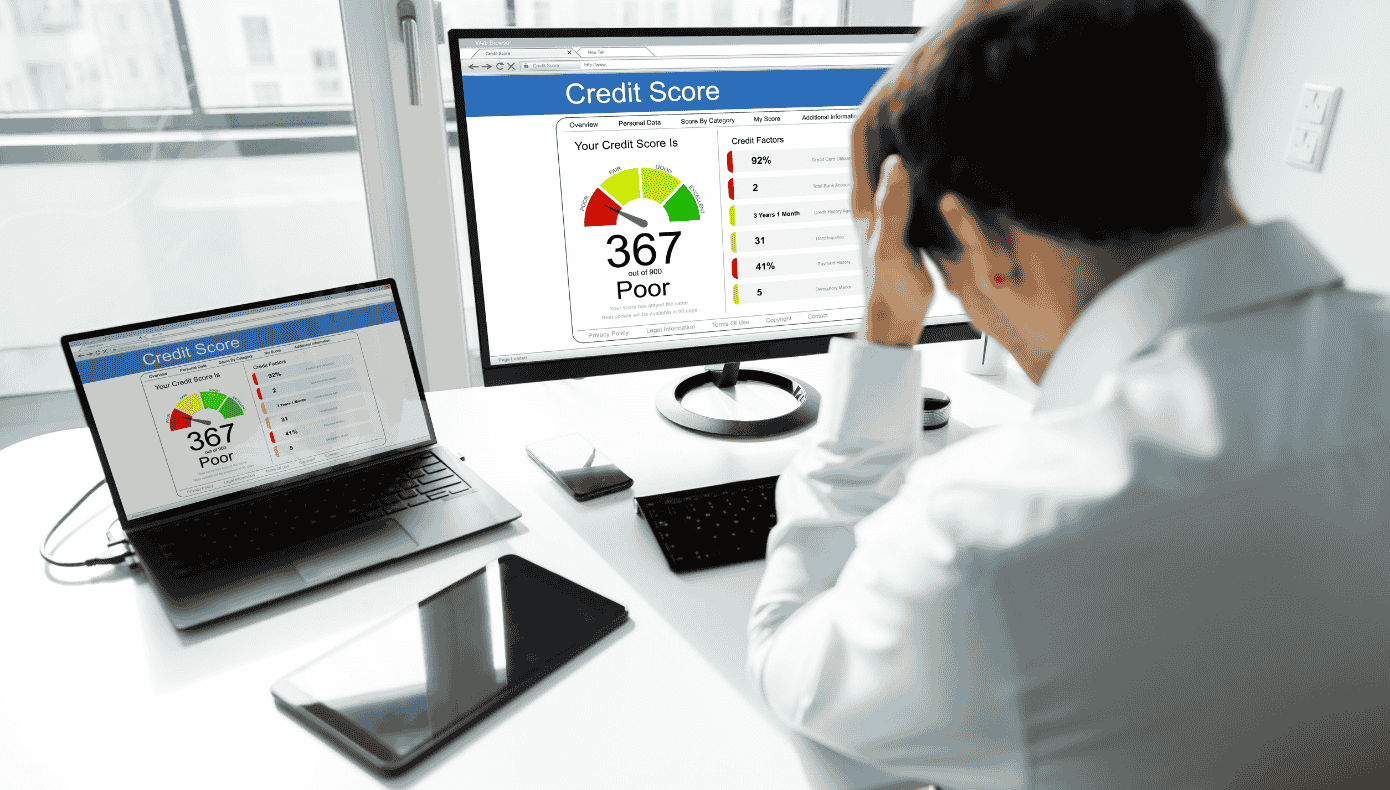

The Hidden Ways Poor Credit Can Impact Your Daily Life

Most people associate credit scores with applying for a loan or credit card. And those are obvious examples. But poor credit affects far more than borrowing. In fact, there are hidden ways poor credit can impact your daily life, from higher utility bills to limited housing options - often without you even realising it. [more...]

Credit Builder Cards: Are They Worth It?

Building or repairing your credit score can feel like a challenge, especially if you’ve faced financial setbacks or have little borrowing history. One option often recommended in the UK is a credit builder card. But are they really worth it, and do they make a difference to your credit profile? [more...]

Electoral Roll and Credit Scores: Why Registration Matters

Your credit score is a key factor in whether lenders approve you for loans, credit cards, or mortgages. While many people focus on paying bills on time and reducing debt, there’s one often-overlooked factor that can make a big difference – being on the electoral roll. In the UK, your electoral roll status is more important to your credit score than you might think. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.