Bad Credit? Here’s How to Rebuild Your Credit Score in the UK

A poor credit score can feel like a financial roadblock, making it harder to get loans, credit cards, or even a mobile phone contract. But the good news? With the right steps, you can rebuild your credit rating over time. This guide explains practical strategies to improve your UK credit score and regain financial flexibility. [more...]

How to Clear County Court Judgements

A CCJ will be recorded in the Register of Judgments, Orders, and Fines, and it will appear on your credit report. If you pay off the debt in full within 30 days of receiving the judgment, you can apply to have the CCJ removed. Otherwise, it will stay on the register for six years, severely impacting your ability to get credit, loans, or even a bank account in the future. [more...]

Understanding Soft vs. Hard Credit Checks: What’s the Difference?

When applying for credit in the UK, lenders may perform either a soft credit check or a hard credit check—but what’s the difference, and how do they impact your credit score? This guide explains both types of checks, when they’re used, and how they affect your financial profile. [more...]

Bankruptcy and Your Credit Score

Bankruptcy is a legal status for individuals unable to repay their debts. It’s typically only an option if you owe more than £5,000 and is considered a last resort because it comes with fairly serious and ongoing consequences. When you declare bankruptcy, your assets are typically used to pay off the debts you owe. [more...]

Credit Checks for Renters: How Your Credit Score Affects Your Ability to Rent a Home?

Finding a rental property in the UK can be competitive, and landlords often conduct credit checks to assess potential tenants' financial reliability. If you're wondering how your credit score impacts your ability to rent, here’s what you need to know. [more...]

What You Need to Know About Mortgage Credit Score

There are many things to keep in mind when taking a mortgage. But the most important thing is the mortgage credit score. This score basically tells you how reliable you are in repaying the loan. If your score is good, you will easily get a mortgage. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

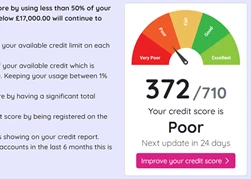

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.