What Is a Good Credit Score?

8th Jan 2024

Your credit score is one of the most important factors influencing your eligibility for credit – whether it's a loan, credit card, mobile phone contract, or mortgage. This three-digit number has a huge effect on your financial life. Lenders, such as banks or car dealership look at your credit score when deciding whether to extend credit to you. The better you've managed bills and debts in the past, the more favourable your credit score, and better the chances of securing loans and better deals on interest rates.

Understanding Credit Checks

Before making any credit application, you can proactively check your credit score online, free of charge. The main credit reference agencies in the UK are Equifax, Experian, and TransUnion. Each agency has its own scoring scale system, so your numbers will be different depending on which agency you look at. Your credit score will be affected by factors such as outstanding debt, credit applications, credit utilisation ratio (how much credit you are using compared with how much you have available to you); and perhaps most importantly how good you are at paying back your debts on time.

Credit Referencing Agencies

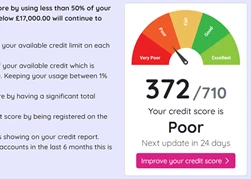

As each credit referencing agency uses a different numerical scale when evaluating consumers, it’s probably best to choose one agency and track how your numbers change over time rather than looking at various different sites. Most credit reference agencies will make it easy for you to understand what is going on by sorting scores into various categories ranging from poor at the bottom, through average, to good or excellent. Knowing which category your credit score falls into is probably more important than knowing the actual numbers.

Significance of a Good Credit Score

A good credit score shows to lenders that you are a lower-risk borrower. It gives you a better chance of being accepted for zero percent deals, or a higher credit limit. Eligibility checker tools on many finance company websites help you assess the likelihood of acceptance without leaving a trace on your credit file, making future credit applications smoother. This is what is known as a soft credit check, or soft search.

Improving Your Credit Score

Building up your credit score can take some time, but swift and effective methods for boosting your credit score include being on the electoral roll, asking for corrections of any mistakes you find on your file, and closing old accounts which you no longer use. Longer term strategies involve making sure you make repayments on time and maintaining a credit card balance below 30% of your total limit. A bad credit score doesn’t rule you out from getting credit altogether, it just means that you might have to shop around a bit harder to find a product which is suitable for your needs.

Understanding, checking, and improving your credit score gives you the knowledge and confidence which you need to manage your finances. Although there are some quick actions you can take to improve your score, it might take longer to deal with a longer history of poor financial management.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.