Defaults can significantly affect your ability to borrow money or access credit in the UK. Understanding how long they remain on your report, and how to recover from them, is essential for managing your financial health.

To stay informed about your credit history and status, you can check your report easily with Credit Check Online.

What Is a Default on a Credit Report?

A default occurs when you repeatedly miss payments on a credit agreement, such as a loan, mortgage, or credit card. Typically, lenders issue a default notice after three to six months of missed payments. This means the agreement has broken down, and the account may be closed.

Once reported to credit reference agencies (Experian, Equifax, and TransUnion), the default appears on your credit report, serving as a warning to future lenders.

How Long Does a Default Stay on Your Credit Report?

A default stays on your credit report for six years from the default date — not from the date you clear the debt. Whether you pay the balance off or not, the entry will remain for the full six years.

However, paying off the debt can still work in your favour, as your report will show the account as satisfied. This signals to lenders that while you faced financial difficulties in the past, you have since taken responsibility and resolved the issue.

Can You Remove a Default Before Six Years?

You can only have a default removed early if it was added in error. For example, if you were up to date with payments or if the lender failed to follow the correct process.

In such cases, you can:

-

Contact the lender directly and request a correction

-

Raise a dispute with the relevant credit reference agency

-

Provide evidence to support your claim

If the default is valid, however, it will remain on your record until the six-year period expires.

What Happens After Six Years?

After six years, the default automatically drops off your credit report. It will no longer affect your credit score, and lenders won’t see it during credit checks.

If the debt is still unpaid after six years and no court action has been taken, it may also become statute-barred, meaning the lender can no longer pursue it legally under the Limitation Act 1980.

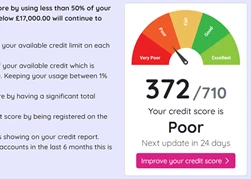

Rebuilding Your Credit After a Default

Once a default appears on your file, rebuilding your creditworthiness takes time and consistent effort. You can improve your score by:

-

Making all future payments on time

-

Registering on the electoral roll

-

Keeping credit card balances low

-

Avoiding unnecessary credit applications

Gradually, your positive financial behaviour will outweigh the old default, especially once it is marked as “satisfied.”

FAQ

How long does a default affect my credit score?

A default affects your credit score for six years from the default date.

Can lenders see paid defaults?

Yes, but they’ll appear as satisfied, which can improve how lenders view your credit history.

What if my default is incorrect?

You can dispute the entry with your lender or credit agency to have it removed if proven inaccurate.

Keep track of your credit health and spot issues early by checking your credit report with Credit Check Online.