10 Crazy Things That Can Hurt Your Credit Score Without You Knowing

26th Sep 2025

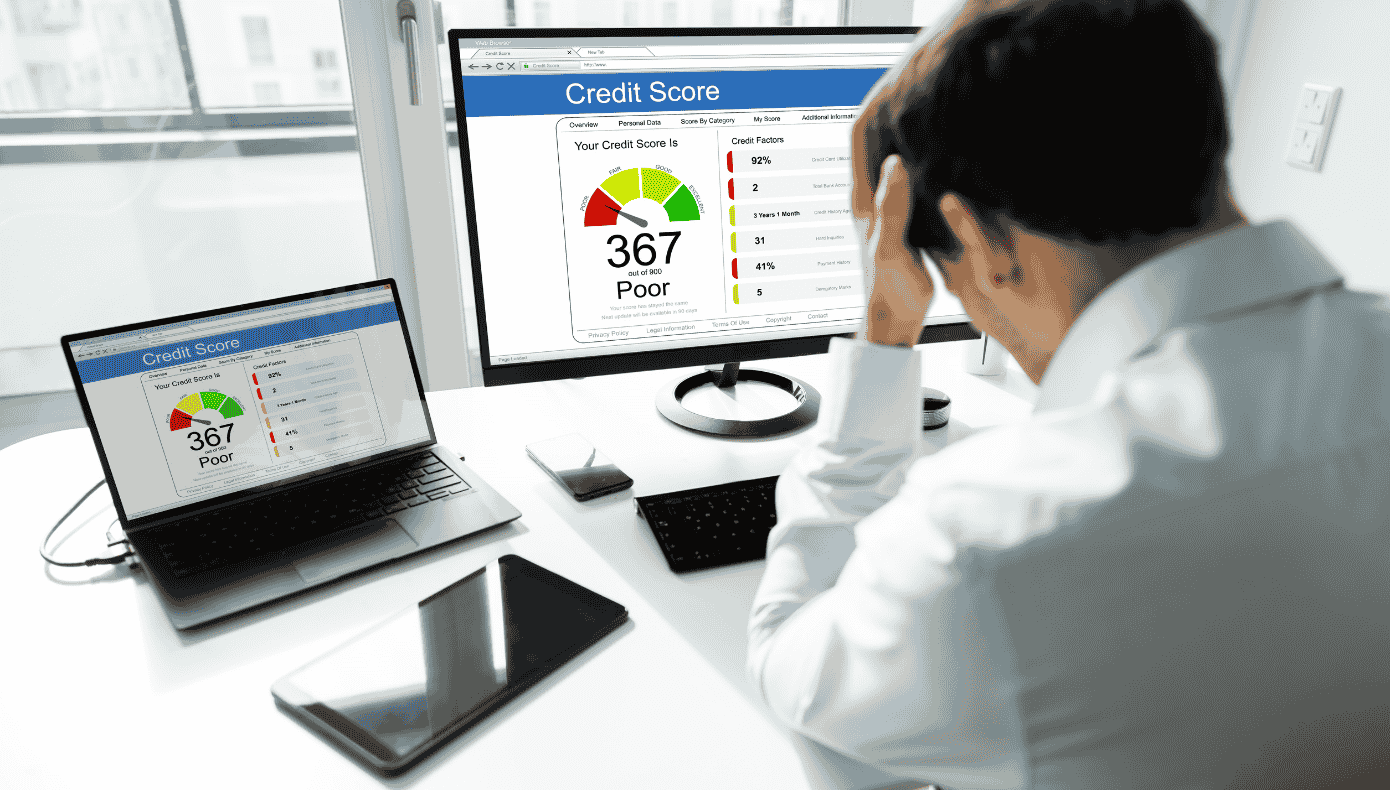

Your credit score can feel like an invisible number, quietly influencing your financial life. From getting a mortgage to opening a new bank account, your credit score is more important than many people realise. Most UK residents know the basics - pay bills on time, don’t miss payments - but there are some unexpected things that can damage your credit score without you even knowing.

In this article, we’ll jump into 10 crazy things that can hurt your credit score, and we’ll show you how to protect yourself. Plus, we’ll highlight how to check your credit score in the UK and which free credit score checker tools you can use to monitor it. If you haven’t checked your score recently, start now at Credit Check Online for free.

1. Missed Direct Debits

Even a single missed direct debit can impact your credit score in the UK. Many people think that missing a small payment isn’t a big deal, but lenders may report missed payments to credit reference agencies. This is why it’s important to check my credit score UK regularly, so you’re aware of any dips.

Tip: Set up automatic payments for recurring bills and track your bank statements to avoid surprises. Don’t wait - check your credit score today at Credit Check Online.

2. High Credit Utilisation

Credit utilisation is the ratio of your used credit compared to your available credit. Using too much of your credit limit can signal risk to lenders. Ideally, keep your utilisation under 30%.

A high utilisation can affect your credit score check results, even if you make all your payments on time. To stay on top of it, regularly check your credit score using a free credit score checker like Credit Check Online.

3. Multiple Hard Credit Checks

Applying for lots of credit in a short period can hurt your credit score. Every time you apply, lenders perform a hard credit check. Too many in a short timeframe can make lenders wary, affecting your ability to get loans, mortgages, or credit cards.

Before applying, it’s a good idea to check my credit score UK to understand how lenders may view your applications. Start with a free check at Credit Check Online.

4. Ignoring Small Debts

Even small unpaid debts, like council tax arrears, library fines, or phone bills, can negatively impact your credit score. They may seem insignificant, but in the UK, unpaid debts can be reported and show up on your credit file.

A quick credit score check can alert you to these hidden issues before they escalate. Use Credit Check Online for an instant free check.

5. Leaving Old Accounts Dormant

Keeping old credit accounts inactive might seem harmless, but it can reduce the average length of your credit history. Lenders prefer seeing long-standing accounts in good standing.

To stay on top of your credit history, regularly check your credit score in the UK using a free credit score checker like Credit Check Online.

6. Being an Authorised User on Someone Else’s Debt

If you are an authorised user on another person’s credit account, their late payments can impact your credit score. Even if you’ve never used the account, missed payments will appear on your credit report.

It’s a smart idea to check my credit score periodically to ensure nothing unexpected is affecting your profile. Start today with Credit Check Online.

7. Frequednt Job or Address Changes

While changing jobs or moving homes is common, frequent changes can concern lenders. A stable address and employment history are positive signals on your credit report.

To make sure your credit report is accurate, perform a credit score check and update your records if needed. Credit Check Online makes it easy.

8. Bank Errors

Bank errors can happen, from duplicate reporting to wrongly recorded missed payments. These mistakes can drag down your credit score without you knowing.

Regularly using a free credit score checker allows you to spot and correct errors quickly. Don’t wait until a lender sees it first! Start your check at Credit Check Online.

9. Default Notices

Missed repayments that escalate into defaults are extremely damaging to your credit score. Defaults stay on your credit report for six years in the UK and can make borrowing more expensive.

Check your report regularly, and if you spot a potential default, check my credit score UK to see how it has affected your overall score. Credit Check Online can help.

10. Ignoring Your Credit Report

Finally, many UK residents neglect their credit reports altogether. Errors, old debts, or outdated information can silently drag down your score. Regular credit score checks are essential to maintain a healthy credit profile.

Using a free credit score checker is the easiest way to monitor your credit regularly and spot any unexpected issues. Check yours today at Credit Check Online.

How to Protect & Improve Your Credit Score

Check Your Credit Score Regularly - Make it a habit to check my credit score UK at least once every few months with Credit Check Online.

- 1. Set Up Automatic Payments - Avoid missed payments by automating bills and loans.

- 2. Keep Credit Utilisation Low - Aim to use less than 30% of your available credit.

- 3. Dispute Errors Quickly - Any inaccuracies found during a credit score check should be corrected immediately.

- 4. Avoid Multiple Credit Applications - Plan applications carefully to prevent multiple hard inquiries.

Conclusion:

Your credit score affects almost every financial decision, from loans to credit cards, insurance, and even renting a property. Even small mistakes can have a big impact if you’re not careful. By understanding these 10 crazy things that can hurt your credit score, regularly using a free credit score checker, and performing a credit score check, you can take control of your finances.

Start today - check my credit score UK for free at Credit Check Online and see where you stand. Protecting your credit is easier than you think, and the right habits can save you thousands over time.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.