Student Loans and Your Credit Score

21st Feb 2025

Each year, £20 billion in student loans is paid out to 1.5 million students across England alone, leaving many with an average debt of £45,000 before they start full-time work. It’s a massive figure, especially for young people, but the real question is: does your student loan affect your credit score? Let’s get that out of the way immediately – student loans will not affect your credit score, because student loans are considered different from other types of borrowing.

Basics of Student Loans

A student loan helps cover the cost of university tuition fees and living expenses. With tuition fees often surpassing £9,000 a year and the cost of living rising, going to university is becoming increasingly expensive. Not many people can fund their studies themselves, even with some support from their parents and potentially a part-time job, which is where student loans come in. To qualify for an undergraduate student loan, you must be enrolled in a full-time course at a recognised university or college. You also need to be a UK national or have settled status and have lived in the UK for at least three years prior to your course.

Student Loan Repayments

Repayments start when your income exceeds a certain threshold. If you’re employed, repayments are automatically deducted from your wages, just like tax and National Insurance. If you’re self-employed, you’ll repay through your self-assessment. Full details are on the government website.

Student loans won’t show up on your credit report, so they don’t directly impact your credit score. This means you could graduate with significant debt but still have a solid credit rating. Since repayments are based on your income, they’re usually more manageable than other loans. If you lose your job or your income falls below the repayment threshold, payments will be paused. If you stick to the repayment plan, your credit score won’t be affected.

Student Loans and Mortgage Applications

Even though student loans don’t show up on your credit report, mortgage lenders will carry out an affordability check, looking at your income and expenses to determine whether you can afford the mortgage repayments. If you have no student loan, your monthly expenses might appear lower compared to someone making student loan repayments. However, lenders often view student loans as a sign of someone with higher earning potential, so they might not see it as a negative.

That said, if you have a low income, a poor credit score, and you’re also paying off a student loan, it could affect your chances of being approved for a mortgage.

Credit Scores for People Leaving University

As we’ve said, student loans themselves won’t appear on your credit report, so they won’t have any impact on your credit score. Lenders tend to view a lack of credit history as a potential risk, so having some positive credit history could work in your favour. If you used other forms of credit (like personal loans, overdrafts, or credit cards) responsibly while studying, it could help improve your credit score, if you made timely payments.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

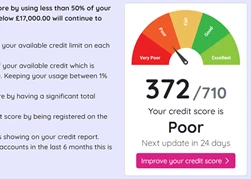

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

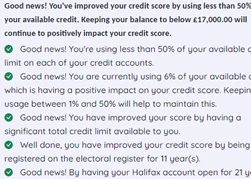

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.